Business Insurance in and around Greensboro

Greensboro! Look no further for small business insurance.

This small business insurance is not risky

State Farm Understands Small Businesses.

Owning a business is a 24/7 commitment. You want to make sure your business and everyone connected to it are covered in the event of some unexpected catastrophe or trouble. And you also want to care for any staff and customers who become injured on your property.

Greensboro! Look no further for small business insurance.

This small business insurance is not risky

Get Down To Business With State Farm

No one knows what tomorrow will bring—especially in the business world. Since even your brightest plans can't predict consumer demand or global catastrophes. In business, you can be certain of one thing: nothing is certain. That’s why it makes good sense to plan for uncertainty with a State Farm small business policy. Business insurance covers your business from all kinds of mishaps and troubles.. It protects your hard work with coverage like extra liability and errors and omissions liability. Fantastic coverage like this is why Greensboro business owners choose State Farm insurance. State Farm agent John Wagner can help design a policy for the level of coverage you have in mind. If troubles find you, John Wagner can be there to help you file your claim and help your business life go right again.

Take the next step of preparation and visit State Farm agent John Wagner's team. They're happy to help you learn more about the options that may be right for you and your small business!

Simple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.

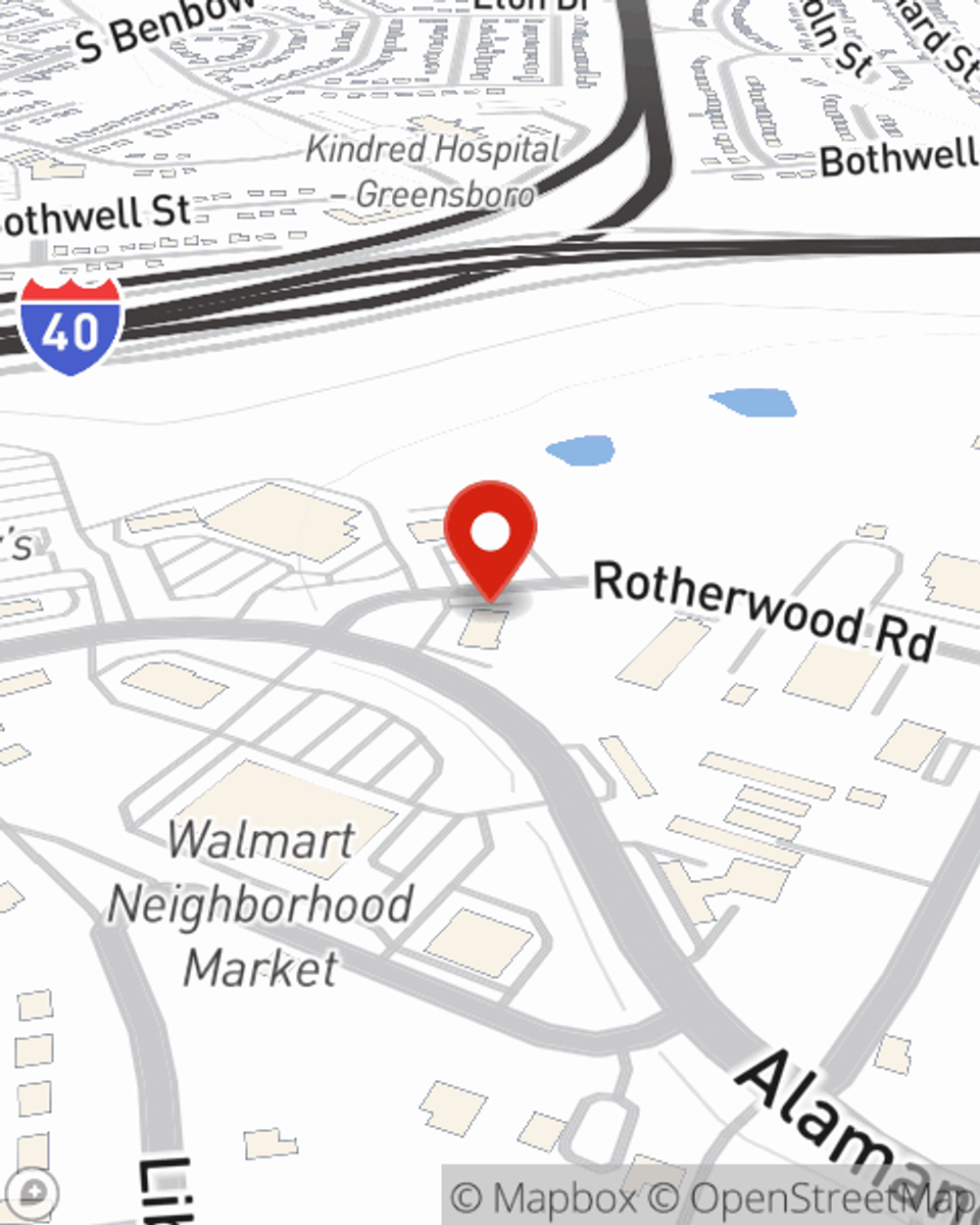

John Wagner

State Farm® Insurance AgentSimple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.